Losing a pet is one of the hardest things any pet owner can face, and it often comes with unexpected costs. While pet insurance can help with many medical expenses, many people wonder if it covers cremation costs as well. This article will break down what pet insurance typically covers, particularly regarding end-of-life services like cremation, and what options you have for planning these expenses.

Key Takeaways

- Most pet insurance plans do not cover cremation costs since they see it as a non-medical service.

- Some providers offer a mortality benefit that can help with end-of-life expenses, including cremation.

- Cremation can vary in cost based on the type you choose, with communal being the cheapest and private the most expensive.

- It's important to consider setting aside a burial fund or looking into alternatives if you want to cover cremation expenses.

- Always read the details of your pet insurance policy to understand what is and isn't covered regarding end-of-life services.

Understanding Pet Insurance Coverage

What Is Pet Insurance?

Pet insurance is designed to help offset the costs of veterinary care. Think of it as a safety net for your pet's health, offering financial assistance when unexpected illnesses or injuries arise. It's not pet health insurance coverage that covers everything, but it can significantly reduce your out-of-pocket expenses.

Common Exclusions in Pet Insurance

Not all pet insurance policies are created equal, and understanding what's not covered is just as important as knowing what is. Common exclusions often include:

- Pre-existing conditions: Any health issue your pet had before the policy started.

- Cosmetic procedures: Tail docking, ear cropping, and other elective surgeries.

- Certain breed-specific conditions: Some breeds are prone to particular health problems that might be excluded.

It's important to carefully review the policy's exclusions to avoid surprises later on. Knowing what isn't covered helps you plan for potential expenses that won't be reimbursed.

Types of Coverage Available

Pet insurance policies come in various forms, each offering different levels of protection. Here's a quick rundown:

- Accident-only: Covers injuries resulting from accidents.

- Accident and illness: Covers both accidents and illnesses.

- Comprehensive: The most extensive coverage, including accidents, illnesses, and sometimes wellness care.

Choosing the right type of coverage depends on your pet's needs and your budget. For example, if you live in Phoenix and are looking for pet cremation services, that would not be covered by standard pet insurance.

Cremation Costs and Pet Insurance

Typical Costs of Pet Cremation

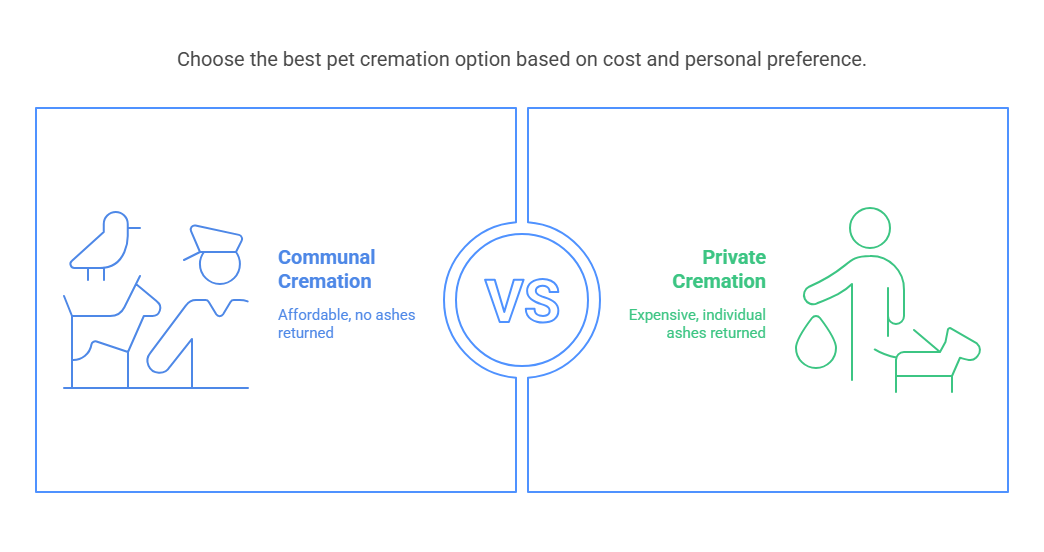

When a beloved pet passes, cremation is a common way to honor their memory. The cost of cremation services for pets can vary quite a bit. Several factors influence the final price, including the type of cremation you choose and the size of your pet. Generally, you'll find three main types of cremation:

- Communal Cremation: This is usually the most affordable option, where multiple pets are cremated together, and the ashes are not returned to the owner.

- Partitioned Cremation: Several pets are cremated in the chamber at the same time, but they are separated so that the cremated remains are kept separate.

- Private Cremation: This is the most expensive option, where your pet is cremated alone, and you receive only their ashes afterward.

The size of your pet also plays a role. Larger animals require more energy and resources for cremation, which translates to higher costs. Location matters too; urban areas or specialized facilities might have higher prices than rural or general veterinary practices.

Why Cremation Is Not Covered

Most pet insurance policies do not include cremation as a covered expense. This is because cremation is typically viewed as a non-medical procedure. Standard pet insurance plans focus on covering veterinary treatments, illnesses, and accidents. Since cremation is considered an end-of-life choice rather than a medical necessity, it usually falls outside the scope of typical coverage. While pet insurance policies offer financial support for unexpected health issues, end-of-life arrangements like cremation are often the owner's responsibility.

Factors Influencing Cremation Prices

Several elements can affect the final cost of pet cremation. Understanding these factors can help you plan and budget accordingly:

- Type of Cremation: As mentioned earlier, private cremation is generally more expensive than communal or partitioned options.

- Pet Size: Larger pets require more energy and resources, leading to higher costs.

- Location: Prices can vary based on the region and the specific cremation service provider. Urban areas or specialized facilities might have higher rates.

- Additional Services: Some facilities offer extra services like urns, memorial items, or paw print keepsakes, which can add to the overall expense.

- Transportation: If you need the facility to pick up your pet, there may be additional transportation fees. Some places offer creative ways of turning ashes into jewelry or art. It's important to research and compare prices from different providers to find the best option for your needs and budget. Don't hesitate to ask for a detailed breakdown of costs to avoid any surprises. Remember to seek pet loss support during this difficult time.

End-of-Life Care Options

Saying goodbye to a pet is never easy. It's a tough time, and thinking about the different options available can feel overwhelming. Let's break down some of the things you might consider when your pet's health is declining.

Euthanasia Coverage

Euthanasia is often the most compassionate choice when a pet's quality of life diminishes due to age or illness. Many pet insurance policies will cover the cost of euthanasia, but it's important to check your specific policy. Some policies might only cover euthanasia if it's deemed medically necessary by a vet. It's also worth noting that some policies may have limits on the amount they'll reimburse for this service. If you are looking for peaceful passing with dignity, there are services that can help.

Memorial Items and Their Costs

After a pet passes, many owners want to honor their memory with memorial items. These can range from simple things like paw print keepsakes to more elaborate urns or even memorial jewelry. The costs can vary widely depending on what you choose. A basic urn might cost around $50, while a custom-made piece could easily run into the hundreds. Some pet insurance policies might offer limited coverage for these items, but it's not very common.

Palliative Care Considerations

Palliative care focuses on making your pet comfortable during their final days or weeks. This can include pain management, assisted feeding, and other supportive therapies. The goal is to improve their quality of life as much as possible. Palliative care can be a good option if you're not ready to consider euthanasia but your pet is clearly suffering. However, it's important to understand that palliative care can be expensive, and it's not always covered by pet insurance. Talk to your vet about whether palliative care is right for your pet and what the costs might be.

Palliative care aims to provide comfort and relieve suffering, but it doesn't cure the underlying disease. It's about managing symptoms and ensuring your pet has the best possible quality of life for the time they have left. This might involve regular vet visits, medication, and adjustments to their environment to make them more comfortable.

Specialized Coverage for End-of-Life Services

It's a tough reality, but thinking about end-of-life care for our pets is part of responsible pet ownership. While most standard pet insurance plans focus on accidents and illnesses, some providers offer specialized coverage that includes mortality benefits or end-of-life services. These plans can help ease the financial burden during an already emotional time.

Providers Offering Mortality Benefits

Several pet insurance companies include some form of end-of-life care in their policies. For example, ASPCA offers what they call Rainbow Bridge Support, which covers euthanasia, cremation, and burial. Embrace covers humane euthanasia under their accident and illness policy and offers reimbursement for memorial items under their optional Wellness Rewards plan. Figo covers veterinarian-recommended euthanasia and medically necessary treatment. Hartville covers end-of-life expenses under both their accident-only and Complete Coverage policies. Lemonade’s base policy is more basic, so it's important to check the specifics. Nationwide historically included a benefit for euthanasia, but their accident-only plans offer minimal support. It's worth noting that Healthy Paws pays in full for euthanasia, but doesn't cover burial or cremation. Pets Best, Trupanion, and FIGO also cover euthanasia but not cremation or burial. Fetch reimburses the purchase price of pets euthanized due to injury or illness. It's important to remember that some providers may have age restrictions or other limitations.

Comparing Coverage Options

When comparing specialized coverage, look beyond just whether euthanasia or cremation is covered. Consider these factors:

- Coverage Limits: What's the maximum amount the policy will pay out for end-of-life services?

- Waiting Periods: Are there any waiting periods before the coverage takes effect?

- Age Restrictions: Are there age limits for coverage?

- Specific Exclusions: What specific services or items are not covered?

- Bundling Options: Can you bundle end-of-life coverage with other wellness benefits?

It's a good idea to get quotes from several different providers and carefully compare their coverage options. Don't just focus on the monthly premium; look at the overall value and what you'll actually get in return.

Limitations of Specialized Plans

Even with specialized coverage, there can be limitations. Some plans may only cover euthanasia if it's deemed medically necessary by a veterinarian. Others may have strict definitions of what constitutes a covered memorial item. It's also important to understand that some plans may not cover pre-existing conditions or age-related illnesses. Always read the fine print and ask questions to ensure you understand the policy's limitations. For example, some policies may not cover euthanasia and cremation if your pet has a pre-existing condition.

Planning for Pet Cremation Expenses

Losing a pet is tough, and the last thing you want to worry about is money. While pet insurance might not always cover cremation, there are ways to plan ahead and ease the financial burden. Let's explore some options.

Setting Up a Burial Fund

One straightforward approach is to create a dedicated savings account for end-of-life pet care. Even small, regular contributions can add up over time. This fund can cover cremation costs, memorial items, or even preventive measures to extend your pet's healthy years. Consider these points when setting up your fund:

- Estimate potential costs: Research cremation services and pet burial options in your area to get an idea of the expenses involved.

- Set a savings goal: Determine how much you need to save based on your estimated costs.

- Automate contributions: Set up automatic transfers from your checking account to your burial fund to ensure consistent savings.

Alternatives to Pet Insurance

If pet insurance doesn't fit your budget or doesn't offer the specific coverage you need, explore these alternatives:

- Pre-need arrangements: Some cremation providers allow you to pre-pay for services, often at a discounted rate. This can lock in prices and ease the burden on your family later.

- Veterinary payment plans: Some veterinary clinics offer payment plans or financing options for end-of-life care, including euthanasia and cremation.

- Crowdfunding: In some cases, crowdfunding platforms can help raise funds for unexpected pet care expenses.

Planning ahead can significantly reduce the stress associated with animal funeral costs. By exploring different options and setting aside funds, you can ensure your pet receives the dignified farewell they deserve without causing financial strain.

Choosing the Right Cremation Service

Selecting a cremation service is a personal decision. Consider these factors when making your choice:

- Types of cremation: Understand the different types of cremation available (private, communal, partitioned) and their associated costs.

- Reputation and reviews: Research different providers and read online reviews to gauge their reputation and quality of service.

- Location and convenience: Choose a provider that is conveniently located and offers the services you need, such as memorial items or grief support.

Navigating Pet Insurance Policies

Reading the Fine Print

Okay, so you're thinking about getting pet insurance? Smart move! But before you sign on the dotted line, you really need to read the fine print. I know, I know, it's boring. But trust me, it can save you a lot of headaches later. Pay close attention to what's covered and, more importantly, what's not. Look for things like waiting periods, annual limits, and exclusions for certain breeds or pre-existing conditions. It's all in there, just waiting to surprise you if you don't read it!

Questions to Ask Your Insurer

Don't be shy about asking questions! Seriously, your insurer is there to help you understand your policy. Here are a few to get you started:

- What's the deductible, and how does it work?

- Are there any limits on how much I can claim each year?

- What's the process for filing a claim, and how long does it usually take to get reimbursed?

- Does the policy cover pre-existing conditions after a certain waiting period?

It's better to ask too many questions upfront than to be caught off guard later when you need to file a claim. Make sure you understand the answers and feel comfortable with the policy before committing.

Understanding Policy Riders

Policy riders are like add-ons to your pet insurance. They can provide extra coverage for specific things, like wellness care or even end-of-life expenses. But are they worth it? That depends on your pet's needs and your budget. For example, a wellness rider might cover routine checkups and vaccinations, which can be great if you want to spread out the cost of preventative care. However, they often come with an extra premium, so you'll need to weigh the costs and benefits. Some companies offer dog insurance with specific riders, so shop around!

Finding the Right Pet Insurance Provider

Researching Different Providers

Okay, so you're in the market for pet insurance. That's great! But where do you even start? There are so many companies out there, all promising the best coverage for your furry friend. Start by making a list of potential providers. Look at well-known companies, but don't be afraid to check out some of the smaller, newer ones too. Read online reviews, but take them with a grain of salt – everyone's experience is different.

Evaluating Coverage Options

Now that you have a list of providers, it's time to dig into the details. What exactly does each plan cover? Does it include accidents, illnesses, hereditary conditions, or just the basics? Pay close attention to the fine print. Some plans have annual limits, deductibles, or co-pays that can significantly impact your out-of-pocket costs. Think about your pet's specific needs and choose a plan that fits those needs. For example, if you have a breed prone to certain health issues, make sure those are covered. It's also worth checking if the plan covers end of life benefits.

Getting Quotes for Pet Insurance

Alright, you've done your research and narrowed down your options. Now it's time for the fun part: getting quotes! Most pet insurance companies have online quote tools that are quick and easy to use. Just enter some basic information about your pet (age, breed, location) and you'll get a personalized quote. Compare quotes from different providers side-by-side to see which one offers the best value for your money. Don't just focus on the monthly premium – consider the overall cost, including deductibles and co-pays.

Remember, the cheapest plan isn't always the best. It's important to find a balance between affordability and comprehensive coverage. You want to make sure your pet is protected without breaking the bank.

Final Thoughts on Pet Insurance and Cremation

In the end, most pet insurance plans don’t cover cremation costs. It’s a tough situation because losing a pet is hard enough without worrying about extra expenses. Some companies do offer a little help, like a mortality benefit, but it’s not the norm. If you’re thinking about how to handle these costs, it might be a good idea to set aside some money ahead of time. That way, when the time comes, you won’t be caught off guard. Just remember to check with your insurance provider to see what they cover, so you’re not left in the dark when you need it most.

Frequently Asked Questions

Does pet insurance typically cover cremation costs?

Most pet insurance plans do not cover cremation costs because they see it as a non-medical service.

Are there any insurance companies that cover cremation?

Some insurance providers like Nationwide and MetLife offer a mortality benefit that can help with cremation costs.

What are the average costs of pet cremation?

Pet cremation costs can vary, but they usually range from a low amount to a few hundred dollars.

Can I get coverage for euthanasia through pet insurance?

Yes, many pet insurance plans cover euthanasia if it is recommended by a veterinarian.

What should I do if my pet passes away?

You might want to set aside some money for cremation or burial, as these expenses are often not covered by insurance.

Are there alternatives to pet insurance for covering end-of-life costs?

Yes, some people choose to create a burial fund or look for specialized plans that include end-of-life services.